This blog post was written by Gordon Seabright, a member of our Board of Trustees and supporter of Five Talents.

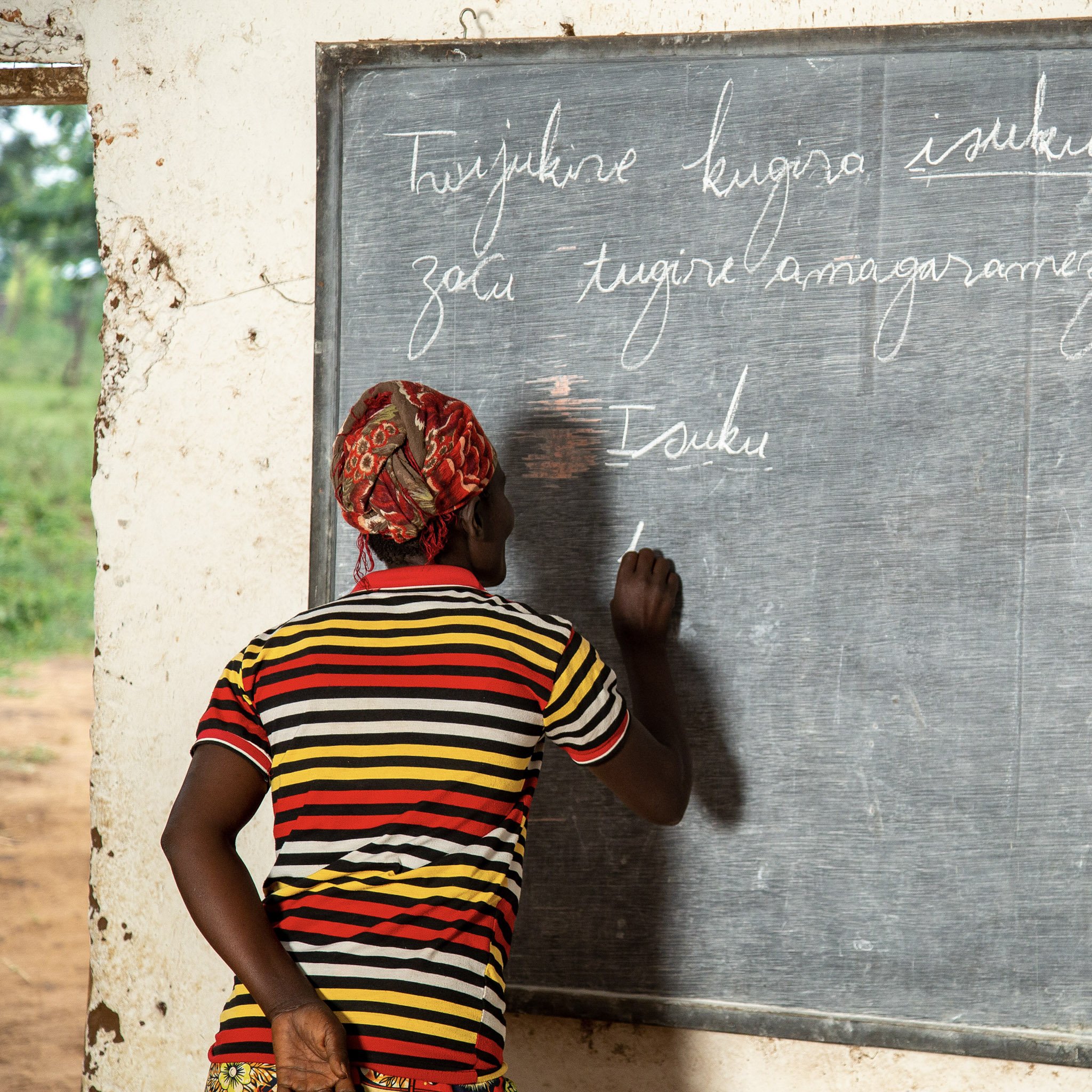

In late October I travelled with Rachel, the CEO of Five Talents, to visit Literacy & Savings Groups in Aru, a town in the far northeast of the Democratic Republic of Congo (DRC). Five Talents began supporting programmes there in 2018, in partnership with our friends The Mothers’ Union and the Diocese of Aru, and now over 177 local groups have helped 2,400 people (the vast majority of Group members are women) to build their businesses and support their families and communities.

Rachel and I were keen to see how the programme was going, and what support might be helpful to increase their numbers and the impact they’re having.

Getting to Aru is an adventure in itself. To reach eastern DRC you travel through Uganda, and the border marks a set of dramatic changes; no tarmac roads, no electricity, sporadic water, and trickiest for me, no English speakers! My first impressions of DRC were the lushness of the green vegetation and the bumpiness of the red clay roads, and also the lack of wisdom of any visitor taking a photo of the border post (that would be me, using my schoolboy French to talk my way out of being arrested within ten minutes of entering the country).

The problems faced by DRC are well known yet largely unreported in the UK. Militia warfare, lack of infrastructure, theft of natural resources, Ebola outbreaks and climate change all make life profoundly challenging, and as visitors we could only admire the resilience of those who are building businesses in Aru. We were overwhelmed with the generosity of the welcomes we received, first from the Archbishop and his team at the cathedral in the town, and then from villagers who included us in their Literacy and Savings Groups.

DR Congo only features in the British media, if at all, as a place of conflict. There’s a lot more to it, though. It was clear that enthusiastic visitors from far away were extremely welcome, and if ever there was a place where the community is driving its own development, this is it. We provided entertainment in our own ways, Rachel through graceful speeches of thanks in fluent French and Kiswahili, and me through the comic value of my attempts to speak French, much to the joy/horror of my new friend Canon Nzua. Rachel’s reward was to be presented with the gift of a rather confused chicken, which then accompanied us on an extraordinarily bumpy but very beautiful drive back to the town and our hotel, which bore the highly appropriate name “God Alone Knows”.

Five Talents in DR Congo is working with a remarkable group of people, from Archbishop Titre Ande, Maneka Grace, Canon Nzua and Irene Nyambura organising programmes at the centre in Aru to the trainers, leaders, savers and entrepreneurs in villages around the province. It was a great privilege to spend time with them, and although travel to and around DR Congo wasn’t always easy, I wouldn’t hesitate to recommend a visit to anyone keen to see just how much of an impact money raised in the UK can have on the lives of people living in a region that deserves a fair chance to thrive.

If you would like to learn more about visiting a programme please click here or contact us. We’ll be taking trips to Kenya in February 2023 and Tanzania in May 2023 and would love for you to join us.