This blog post was written by Rachel Beale, our Fundraising & Communications Assistant.

Many members in Kenya are experiencing the worst drought the region has seen in 40 years. Others, however, are living through heavy rainfall and extreme flooding. Such unprecedented droughts and flooding have contributed to the loss of livelihoods, food insecurity and malnutrition, and social insecurity of thousands of members across the programmes. The devastating impacts of climate change and such erratic weather are hard to prepare for, and even harder to recover from.

Even worse, climate change disproportionately affects women. But why does this happen?

In many lower income countries, agriculture is the largest employment sector for women- but in many of the areas where we work, women are not allowed to own the land due to traditional cultural beliefs.When a climate shock disrupts or destroys an agricultural business women are left without an income, without savings or assets to fall back on, and have to find a livelihood elsewhere.

Women are often the primary caregivers for their children, and sometimes their wider family, so spend more time and energy procuring food, water and shelter. Therefore, during a drought, for example, women may have even more responsibility and pressure to provide for their family in increasingly difficult circumstances.

Climate shocks threaten the safety of women, increasing the risk of sexual and gender-based violence and trafficking. Women may have to walk further to source food and water, or be forced into sexual exploitation in exchange for goods or services.

In communities where women’s voices are not heard or respected, they may be neglected during the response to a crisis, excluded from decision-making processes, and their needs may not be prioritised.

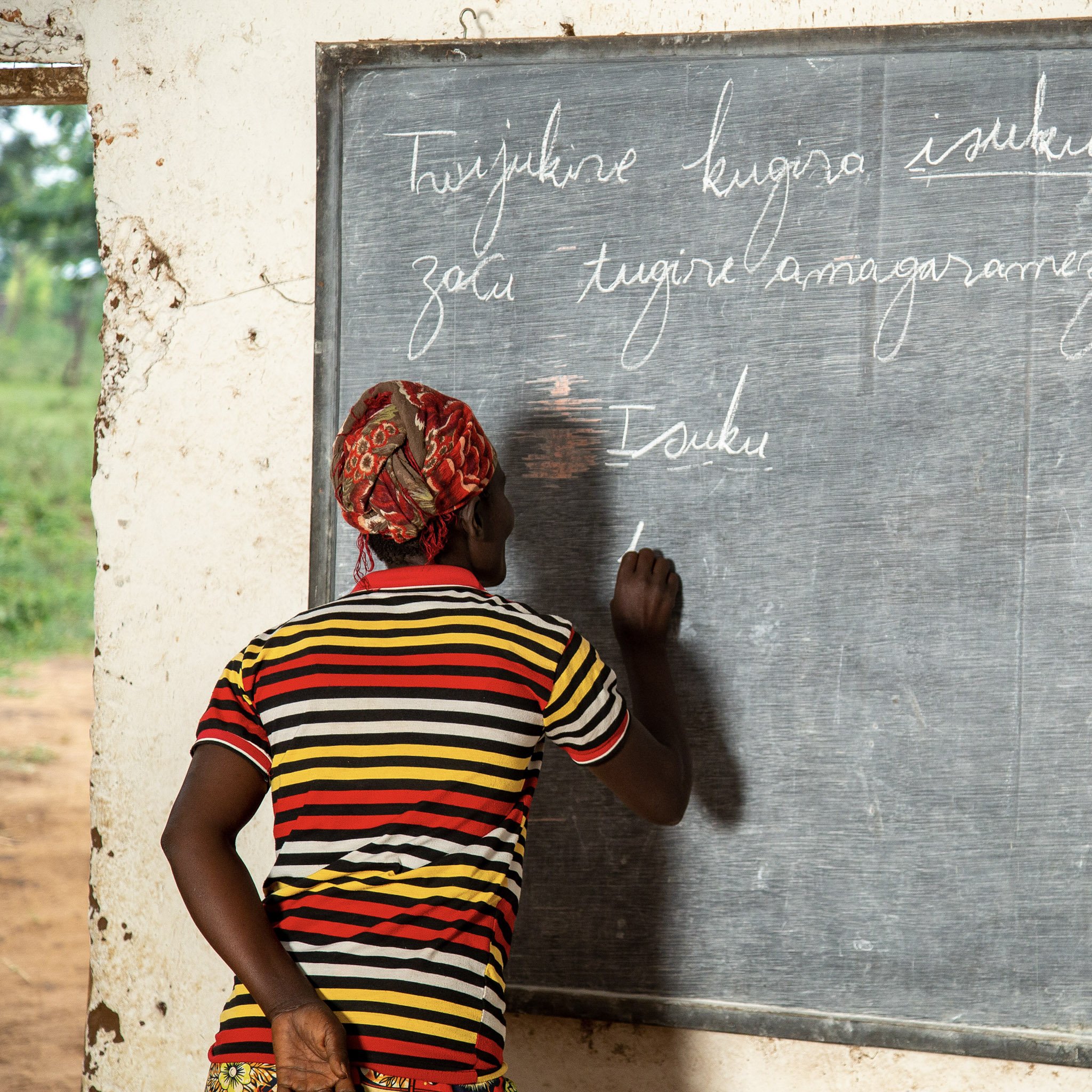

78% of Five Talents partner programme members are women, so supporting members to become resilient against climate shocks and crises is a high priority. Business skills training encourages members to plan ahead, diversify their income streams, and purchase climate-proofing equipment (such as rainwater tanks), or climate resilient crops. As Savings Groups are community-led, women are encouraged to take up leadership roles and claim their voice. During a crisis, this means women can be part of the decision-making process, help coordinate responses, and make sure they are given the support they need. Savings Groups enable members to support each other as a fellowship and address crises together.

We also recognise that women have so much to offer when it comes to combating the impacts of climate change - it is our job to ensure that women are able to put themselves in the best position possible to do so.